If you want to retire early, this Merseyside town is the most affordable place in the UK to do it

and live on Freeview channel 276

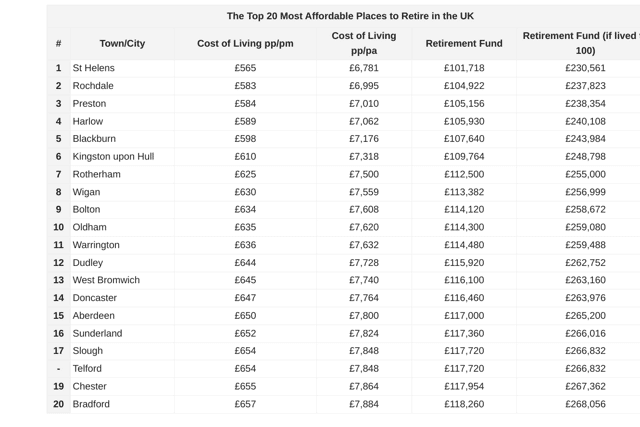

New research has revealed the most affordable places to retire in the UK and a Merseyside town has topped the list of where your money would go furthest.

The study compared the cost of living without rent in the top 100 most populated towns and cities to work out how much cash the average person needs to retire in each.

Advertisement

Hide AdAdvertisement

Hide AdBased on the current retirement age of 66 and average life expectancy of 81 years (79 for men and 82.9 for women) the most affordable place to retire in the country is St Helens.

There’s an 84% price difference between retiring there and retiring in London, the study by money experts Sambla showed. North West neighbours Rochdale and Preston make up the rest of the top three most affordable, with nearby Warrington just outside the top ten.

In the UK, the current state pension is £203.85 per week and can be claimed by people aged 66 or over. However, those born after 5 April 1960 will see a phased increase to 67 then to 68. A state pension works out to around £10,600 per year.

You would need £6,781 per person, per year to sustain you in St Helens. That works out as a retirement fund of £101,718 if you live until 81 years old, or £230,561 if you lived to 100.

Advertisement

Hide AdAdvertisement

Hide AdThe most expensive place to retire in the country is London, at a cost of £12,468 per year, or retirement fund of £187,020. Leeds is the most expensive place to retire in the north of England, at £10,116 per year, which equates to a fund of £151,740.